PCI-DSS COMPLIANCE

- Expert Guidance and Strategic Advice for Proactive Cyber Security

- Assessment, Auditing, and Implementation Services

- Ensure your entire workforce adheres to regulatory compliance

The PCI DSS (Payment Card Industry Data Security Standard) is an information security standard designed to reduce payment card fraud by increasing security controls around cardholder data.

At Fibre IT Solutions, we provide the best advice and guidance on becoming and staying PCI compliant.

Establish cardholder data environment (CDE) scope

Correctly scoping your environment is the crucial first step to becoming PCI compliant. The Cardholder Data Environment (CDE) scope defines the extent to which all PCI DSS controls must be performed. Mistakes in scoping can lead to severe consequences and wasted resources. Rest assured, our PCI experts at Fibre IT Solutions, with their extensive knowledge and experience, will define your CDE's scope to ensure you meet every security and compliance requirement.

The question is, how does your business establish if an asset is in scope? It's simpler than you might think. Any people, process, or technology that stores, processes, or transmits cardholder data is considered within your CDE and in scope for your PCI DSS audit.

The PCI DSS applies to ANY organization, regardless of size or number of transactions, that accepts, transmits or stores any cardholder data. If you are not PCI DSS compliant, we value your business and invite you to get in touch today to speak with one of our advisors for free.

How to define PCI DSS scope?

The rules defined by the PCI Security Standards Council state that the following are within the scope:

1. Any devices that provide security and authentication solutions like a firewall, router, or server

2. IT assets or systems with connectivity into the CDE, whether physical, wireless or virtualized

3. Any asset that traffics cardholder data or is part of the cardholder data flow

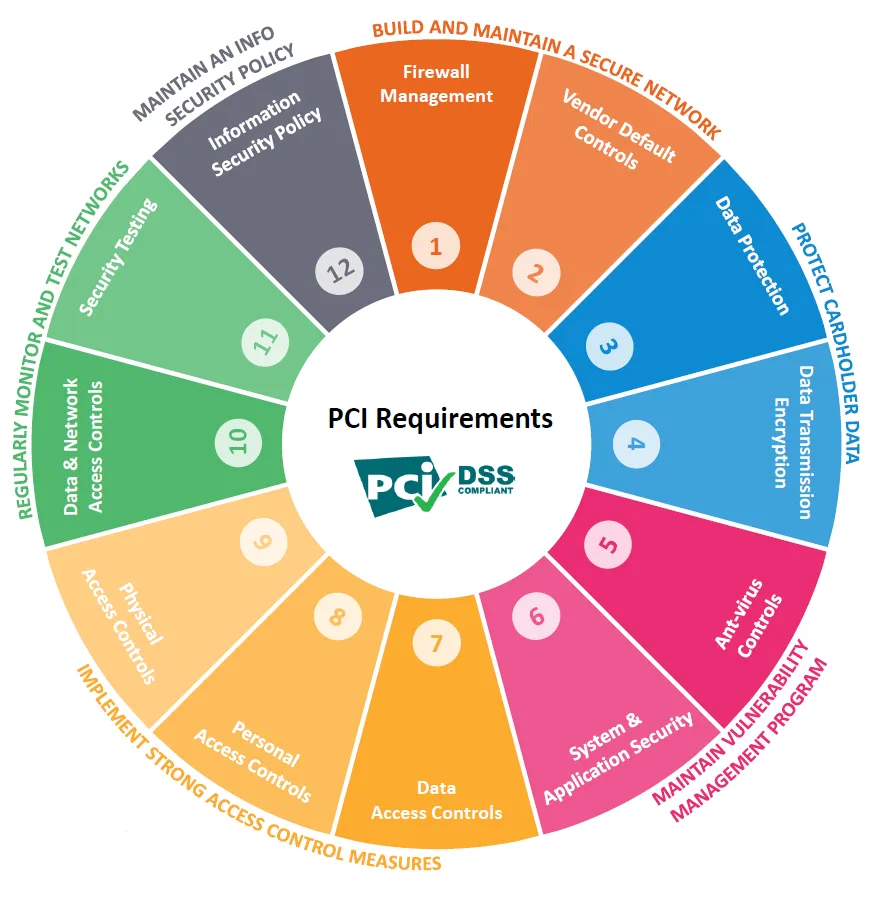

What are the PCI DSS requirements?

There are six categories to consider when making your business PCI Compliant, which are staggered over twelve individual steps.

The twelve steps to achieving PCI Compliance are:

- Secure your network

- Secure Cardholder Data

- Vulnerability Management

- Access Control

- Network Monitoring and Testing

- Maintain an Information Security Policy

Ensure all security requirements are met

To maintain proper payment security, you need a firewall configuration that protects cardholder data and a method for securely storing it. Network segmentation enables organizations to significantly reduce PCI scope by isolating assets from the cardholder data environment. This results in a reduction of your organization’s PCI scope, which in turn reduces costs, time, and effort to achieve compliance, providing a sense of relief. Our highly skilled engineers can ensure your network is segmented correctly, data is encrypted, and you’re leveraging resilient storage solutions to protect every area where cardholder data flows. These solutions provide an added layer of security, ensuring that your data is safe even in the face of potential threats.

Regularly conducting PCI scans is a proactive method to detect vulnerabilities and ensure adequate security measures safeguard payment card data. Adhering to PCI standards through these scans demonstrates your dedication to data security, reinforcing trust among customers and financial partners.

Do I need to be PCI compliant in the UK?

UK organizations handling payment card transactions must adhere to PCI DSS standards, which are rigorously enforced by major card brands like Visa, Mastercard, and American Express. These standards, more than UK law, apply to merchants, service providers, and other entities processing, storing, or transmitting cardholder data, ensuring the security of payment card information.

Alongside card brand requirements, UK businesses may have additional regulatory obligations regarding data protection and cyber security, such as the General Data Protection Regulation (GDPR). While PCI DSS primarily focuses on payment card data security, aligning with its standards not only ensures compliance but also strategically supports your adherence to broader data protection regulations like the GDPR.

Although not legally mandated, non-compliance can lead to severe financial consequences. In case of a breach involving payment details, fines may be imposed by the PCI Security Standards Council on your bank, which could pass these penalties on to your organization. These fines can be substantial, potentially impacting your financial stability.

Furthermore, inadequate security measures can lead to your bank's termination of your business account, severely affecting your credit status and operational capabilities, highlighting the potential disruption to your business.

We only partnered with the best of industry's leading brands.

PCI DSS scanning

After the initial consultancy, we will meticulously perform external vulnerability scanning on your systems, leaving no stone unturned. We will then provide a comprehensive report on the findings, including identified weaknesses and recommended solutions, ensuring you feel secure and well-protected. Akita, with our extensive expertise, can assist in addressing network vulnerabilities upon request from the organization. Once remediation is completed, we will conduct a follow-up scan. Upon successful completion of the scan, a certificate will be issued, ensuring you feel confident and secure in your system's security.

PCI DSS self-assessment questionnaire

In addition to scanning, organizations must complete a self-assessment questionnaire covering payment types and their IT infrastructure. Providing inaccurate information can lead to non-compliance with PCI DSS standards. Akita's cyber security team can assist organizations needing more expertise to complete this questionnaire internally. Suppose the questionnaire identifies potential issues with IT infrastructure or policies. In that case, our consultants can help implement the necessary measures to ensure accurate and compliant reporting.

Explore our other services

Get a FREE consultation

Contact us to discuss your needs further by calling 020 3637 9850 to speak to an Fibre IT specialist.